On Wednesday Nov. 30th, the SMIF class was privileged to have alumni Jim Howland come to speak to the class. Jim is Managing Director of Morgan Stanley Global Private Equity and has been with the firm …

Austin Marcus Pitches CSX – Tues. Nov. 29th

The first stock pitch of the year! On Tuesday, November 29, Austin Marcus pitched CSX, a class 1 American railroad company headquartered in Jacksonville, Florida. CSX has 21,000 route miles …

Continue Reading about Austin Marcus Pitches CSX – Tues. Nov. 29th →

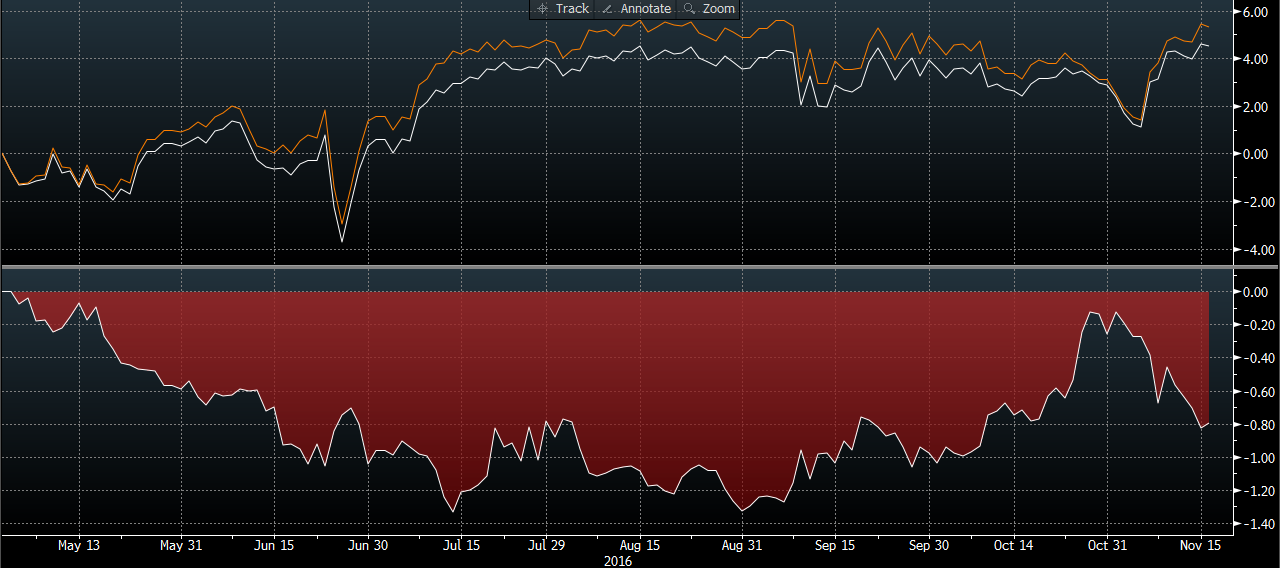

Economic Projections

The SMIF class has examined current market conditions and after extensively evaluating potential upcoming headwinds and tailwinds for the market, we have come to a consensus for key indicator …

Portfolio Update

As of 11/16, the SMIF Portfolio is holding an asset allocation of 2.55% Cash, 11.87% Fixed Income, and 85.62% Equity. This asset allocation has been fairly in line with the tactical benchmark we set …

Susan Lattman ’90 Joins SMIF on Nov. 15

On Tuesday Nov. 15, the SMIF class had the pleasure of hearing some remarks from Susan Lattman, the CFO of Bed, Bath, & Beyond (BBBY). Lattman has been with BBBY for 20 years, having served in a …

Continue Reading about Susan Lattman ’90 Joins SMIF on Nov. 15 →

Effects of a Trump Presidency

Prior to the election, most experts and economists on Wall St. felt that a Clinton victory would be more favorable (than a Trump victory) to the Market. This can be attributed to the fact that the …