Hello, SMIF Alumni and Friends! We, the new Fall 2023 analyst class, would like to introduce ourselves and provide an update on our progress with the portfolio after our first month together. To learn more about our cohort, please visit the “Meet the Analysts” tab on our blog.

At the beginning of the semester, we established our benchmark: 90% S&P 500 and 10% Barclay’s Aggregate Bond Index. Although this seemingly represents a large allocation to equities, Bucknell’s perpetual time horizon gives us the flexibility to invest for long-term growth. Our current asset allocation is consistent with our benchmark.

Since the current SMIF class inherited the portfolio on May 1st, we have achieved a total return of 2.42%, which trails the benchmark by 122 points as of September 25th. Last semester’s class believed the US economy was heading into recession in the second half of 2023. The subsequent overweights in consumer staples and health care hurt our relative performance.

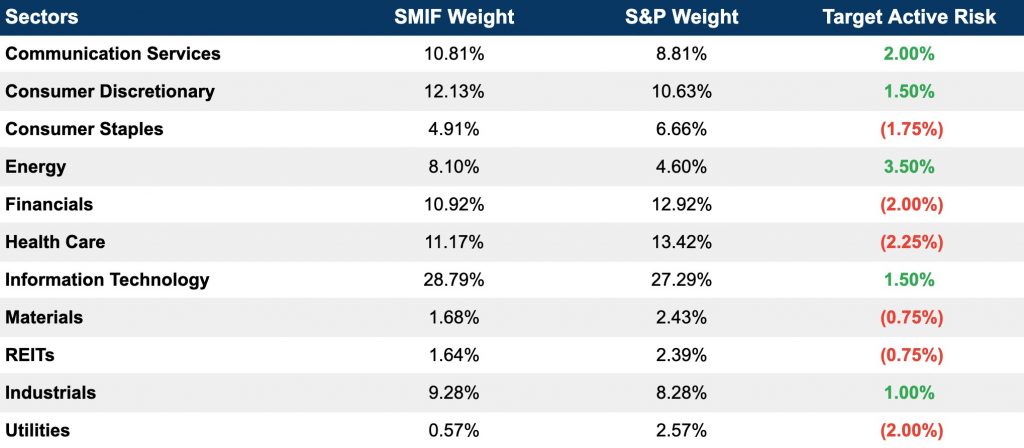

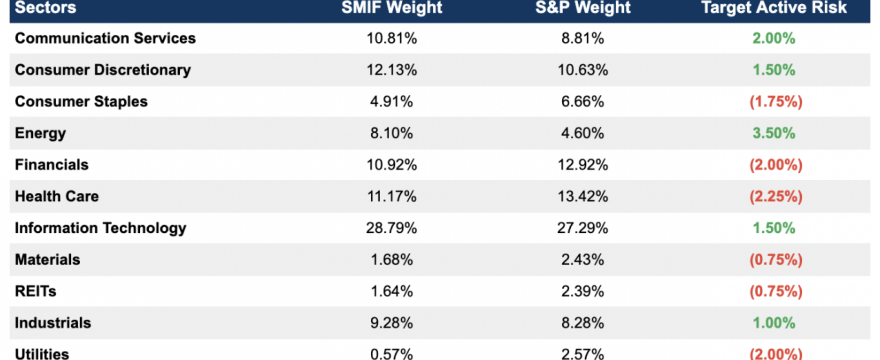

Last week, SMIF selected sector weightings for the equity portion of the portfolio, as seen in the table below. We are looking forward to an exciting year and will continue to update our blog and social media with major events and decisions made by the class as they occur!